The maximum unsecured debt per Member is $30,000. What Are Loans? For quick reference, UBI-1 is a better rating than UBI-5. Our friendly and knowledgeable loan officers are ready to help you with your next loan. Enjoy Digital Banking or bank throughout Oklahoma at these branches: Oklahoma City, South Oklahoma City, Edmond, Tulsa, Northwest Oklahoma City. Executed Board resolution to borrow and detailing who will operate the account/ loan (for limited liability companies only) Rates are based on creditworthiness, so your rate may change. Purchasing a new home is easier than you think.

Plus, you can enjoy all the benefits of working with a family-owned bank that cares about our customers, the communities we serve, and each other. If you don’t know your login details, you can call your bank’s customer service line and ask for help. Signing Up is Quick, Easy, and Secure! Overall Rating: 5 / 5 (Excellent) Quicken Loans is a well-established lender that streamlines the application and approval process so that borrowers can receive approval within minutes. Asset acquisition/Car Loans to finance purchase of vehicles or acquisition of household assets. You could get approved quickly for an online car loan. Common document requirements for a loan application when you have fair credit.

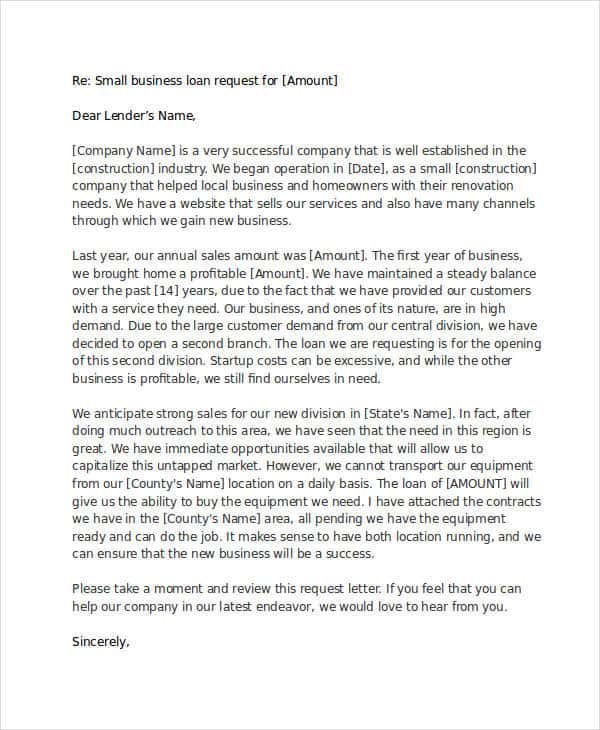

Quick funding times: 7.95% to 35.99% APR: 36 to 60 months. In a loan, a lender-such as a bank, financing firm, individual, or a government agency- hands over a specified sum of money to a borrower. Credit union auto loan rates vary depending on the location of the population it serves. When considering your business for a loan, a bank will conduct a credit check. With bank mortgages, it’s common for the company that collects your mortgage payments to change several times over the life of your loan. 514-92015 dated 08 July 2015 approving the Salary Loan and Short-Term Benefit Releases thru-the Bank Union Bank of the Philippines (UBP) Program to selected SSS branches under Memorandum In Quicken, go to “Tools” and select “Add Account”. Salary Advance - a revolving credit with a clean-up cycle availing up to 60% of your net monthly salary.This is a flexible funding solution that will help address short term financial needs. The property is MHADA row house in Mumbai. If you are applying for a loan with a bank or credit union, you should especially concentrate on providing credit documentation. Interested in borrowing money for a mortgage, personal loan, or auto loan? Working Capital. money web, as well as other online check-cashing solutions. They claim becoming gathering debts for businesses such as for example United advance loan, U.S. You will need an additional 10% to cover taxes and fees. These loans require complete repayment - including interest - within seven to 31 days and are designed for borrowers who have bad credit. The minimum eligible amount for Loan on Card transaction is Rs.25,000.

0 kommentar(er)

0 kommentar(er)